Why the stock market rally is actually signaling an ‘abnormal’ economic recovery, not a V-shaped

- May 12, 2020

- 2 min read

Sectors that typically lead in a recovery are lagging behind, notes Canaccord’s Dwyer

Investors are reading the stock market’s breakneck bounce off the March 23 lows all wrong, says one prominent Wall Street analyst.

There’s a widely held perception that the rally reflects expectations the COVID-19 pandemic will have a piercing but short effect on the economy, with growth rebounding sharply later in the year once the outbreak is corralled, workers return to their jobs and the economy begins humming again.

That isn’t the case, said Tony Dwyer, chief market strategist at Canaccord Genuity, in a Monday note.

“In our view, it hasn’t spiked on the anticipation of a strong economic rebound, but has ramped based on the coronavirus impact and a probable abnormal economic recovery,” he wrote.

It’s “abnormal” because the sectors that usually lead the stock market out of a recession-induced downturn aren’t doing so. Instead, leadership has come largely from big tech stocks and pharmaceuticals rather than financials and cyclical sectors that closely track the ups and downs of the economy, such as industrials and consumer discretionary stocks.

The S&P 500 SPX, +0.01% plunged nearly 34% from a Feb. 19 record close to its March 23 low. The subsequent rebound left the large-cap index just 13.5% below its all-time closing high. Stocks saw a mixed finish on Monday, with the Dow Jones Industrial Average DJIA, -0.44% finishing with a loss of around 109 points, or 0.4%, while the S&P 500 eked out a fractional gain.

The tech-heavy Nasdaq Composite COMP, +0.77% extended its win streak to six sessions, leaving it less than 7% away from its all-time closing high.

Dwyer said he would characterize the market’s “extraordinary move” since the March 23 low and the Federal Reserve’s April 9 announcement of a plan to inject an additional $2.3 trillion into the economy as “economically defensive,” driven by “those megacap growth stocks that benefit from a longer stay and work-from-home economy, or the health care sector involved with the COVID-19 response.”

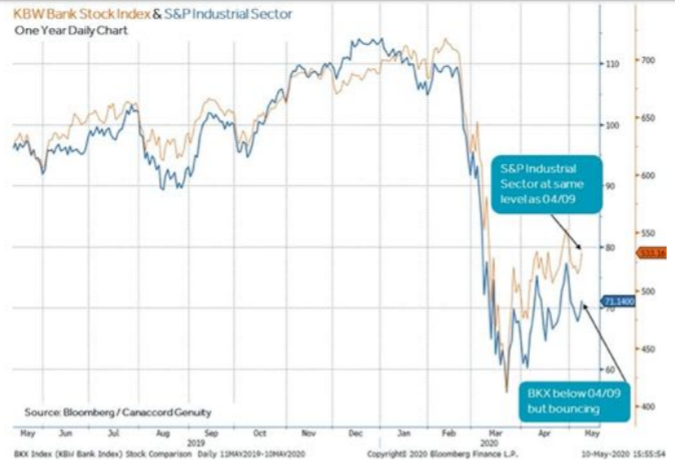

Meanwhile, the KBW Bank Sector Stock Index and the S&P 500 industrial sector remain flat to lower since the Fed’s April 9 announcement, he said. Further evidence that the rally has come amid expectations for a weak recovery is offered by the credit markets, with areas that would point to a sharp rebound showing little or no improvement since that date, Dwyer argued (see chart below).

He isn’t saying investors should fight the Fed. The central bank’s backstop of the corporate and municipal credit market has “likely took the worst-case retest off the table,” he said.

Dwyer, who on March 16 “suspended’ his 3,440 target for the S&P 500 on Monday set a 12-to-18-month target for the large-cap index at 3,000 — around 2.4% above its level from Monday’s close. That reflects his forecast for 2021 earnings per share of $150 and a price-to-earnings ratio of 20.

For the market to make the next leg higher, investors need a stronger signal from credit metrics and economically sensitive sectors of the stock market.

“At this point, if the market was anticipating a ‘V’ recovery, credit would be outpacing stocks, but the opposite is true thus far,” he said.

This article was originally published on MarketWatch

Comments